Lease vs. Buy: Why Leasing a Copier is the Smarter Financial Choice for Dallas Businesses

When acquiring a commercial copier or multifunction printer (MFP), every business owner faces the same decision: Should we buy it outright, or should we lease it? While purchasing is acceptable, leasing a copier offers a range of financial and operational benefits that provide a significant advantage, especially in a dynamic market like Dallas.

If you are contemplating a copier lease in Dallas, here are the key angles to consider before making your final decision.

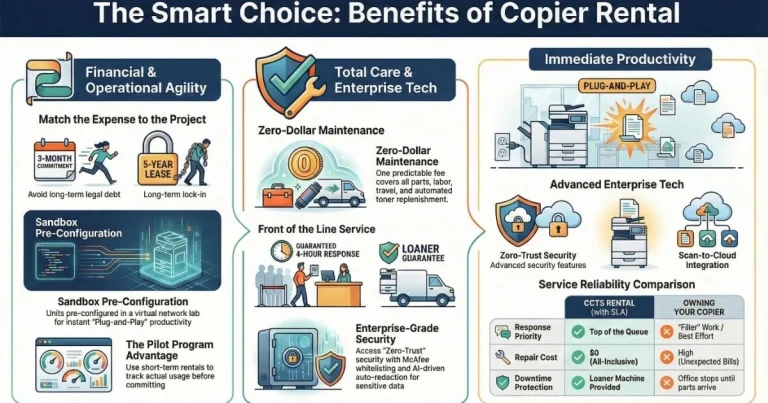

The Top 4 Financial Advantages of Leasing

Leasing equipment, versus buying it, fundamentally impacts your company’s bottom line and balance sheet.

1. Preserves Capital and Credit Lines

- Low Initial Outlay: Leases typically offer 100% financing, requiring significantly less upfront cash compared to the down payment or full cost of an outright purchase.

- Frees Up Capital: Leasing your equipment allows you to retain your working capital and credit lines for core investments—like inventory, marketing, or staffing—that actively grow your business.

2. Tax and Accounting Benefits

- Expense vs. Asset: A lease is typically viewed as a fully deductible operating expense, immediately lowering your company’s taxable income from profits. A purchase, conversely, must be depreciated over several years.

- Sales Tax Deferral: You often save on sales tax when you lease a copier. Instead of incurring a massive tax bill upfront (common when purchasing large, expensive units), you defer these fees over time in many jurisdictions.

3. Balance Sheet Appeal

Unlike a purchase which shows up immediately as a depreciating asset and a liability (if financed), an operating lease often does not appear on your balance sheet as a significant long-term debt, providing a cleaner financial picture.

Operational Benefits: Stay Ahead of the Curve

Beyond finance, leasing provides immense operational flexibility that supports long-term profitability.

4. Continuous Technology Upgrades

The greatest long-term advantage of a copier lease is the ability to upgrade your equipment. Once your lease ends, you can seamlessly transition to the latest model. This ensures your business continues to benefit from advancements in speed, security, and efficiency without ever being stuck with outdated equipment.

5. All-Inclusive Peace of Mind

The best thing about a lease is that the leasing company will shoulder the burden of maintenance. Your fixed monthly contract ensures that service, parts, and labor are covered, keeping your machine running and giving you peace of mind.

- This means you can continue to focus on your work, while our service team ensures everything is up and running.

- For any issue, you have direct access to expert copier repair in Dallas. Copier Repair Dallas

The Alternative: Copier Rental in Dallas

If your needs are only short-term (for conventions, trade shows, or temporary corporate projects), renting a copier offers maximum flexibility without the commitment of a lease. Companies that offer equipment renting, like copier rental in Dallas, can help you get the equipment you need quickly and cost-effectively.

🔗 Your Complete Dallas Office Solution

Whether your need is short-term (rental) or long-term (lease), our team is ready to provide the ideal machine for your business. All our services are locally handled and backed by the national network and quality guarantee of Clear Choice Technical Services.

| Resource/Action | Service Type | Contact Information |

| Request a Rental Quote | Short-Term Rental | Get Your Quote Now |

| Copier Lease Options | Long-Term Acquisition | Copier Lease Dallas |

| Service & Repair | Existing Equipment Maintenance | Copier Repair Dallas |

| Corporate Partner | National Backing & Guarantee | Clear Choice Technical Services |

| Call Us Directly | Immediate Assistance | (972) 525-0888 [tel:+19725250888] |