Operating Lease vs. Capital Lease: Choosing the Right Financial Strategy for Your Copier in Dallas

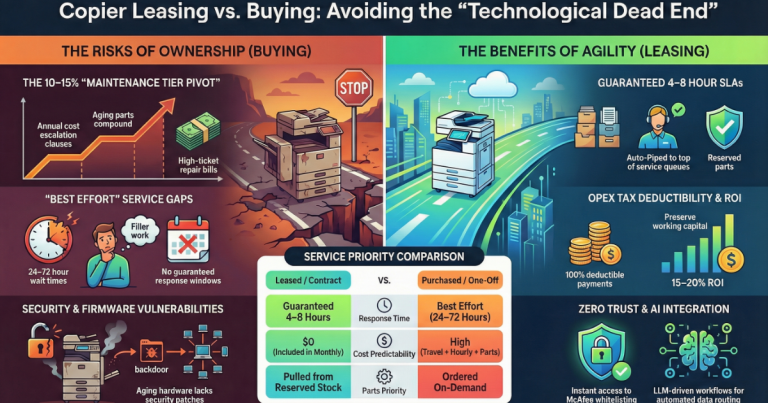

If you’ve decided that a copier lease in Dallas is the right choice over purchasing—saving capital and ensuring technology upgrades—your next step is understanding the two primary types of leases: Operating and Capital (or Finance) Leases.

The choice between the two fundamentally affects your balance sheet, your monthly payment, and whether you ultimately own the equipment. Here’s a breakdown to help you choose the best financial strategy for your business.

1. The Operating Lease: Maximum Flexibility (The Best Choice for Most)

An Operating Lease is essentially a true rental agreement. It is designed for businesses that prioritize low monthly payments and continuous access to the newest technology.

| Feature | Strategic Benefit |

| Balance Sheet Treatment | The equipment is typically kept off your balance sheet, meaning the lease payment is treated as a simple monthly operating expense. |

| Monthly Payment | Usually lower, as you are only paying for the depreciation during the lease term, not the full cost of the copier. |

| End-of-Term Option | Ultimate Flexibility. You can choose to renew the contract with a brand-new, up-to-date copier model, return the equipment, or buy the copier at its fair market value. |

| Ideal For | Businesses focused on keeping their technology current, maintaining a low monthly budget, and keeping debt off the balance sheet. |

2. The Capital/Finance Lease: The Path to Ownership

A Capital Lease (often called a Finance Lease) functions more like a loan disguised as a lease. This option is for businesses determined to own the copier but prefer to pay for it incrementally.

| Feature | Strategic Impact |

| Balance Sheet Treatment | The copier is recorded as a company asset, and the lease obligation is recorded as a liability on the balance sheet. |

| Monthly Payment | Typically higher than an operating lease because your payments are accumulating towards the full cost of the copier. |

| End-of-Term Option | The agreement often includes a bargain purchase option (e.g., $1 buy-out or fixed low price), guaranteeing you ownership at the end of the term. |

| Ideal For | Businesses that plan to use the same machine for many years and want to retain its residual value. |

Making the Right Choice for Your Dallas Business

For the majority of modern businesses, the Operating Lease provides the best financial strategy. It allows you to use newly released models through contract renewal and avoids the headache of owning, depreciating, and eventually disposing of outdated equipment.

Whether you need a full copier lease in Dallas or a short-term copier rental in Dallas, we provide the machine and the peace of mind. You can reach our specialists directly at (972) 525-0888 to discuss which payment structure is best for your unique needs.

🔗 Your Complete Dallas Office Solution

Whether your need is short-term (rental) or long-term (lease), our team is ready to provide the ideal machine for your business. All our services are locally handled and backed by the national network and quality guarantee of Clear Choice Technical Services.

| Resource/Action | Service Type | Contact Information |

| Request a Rental Quote | Short-Term Rental | Get Your Quote Now |

| Copier Lease Options | Long-Term Acquisition | Copier Lease Dallas |

| Service & Repair | Existing Equipment Maintenance | Copier Repair Dallas |

| Corporate Partner | National Backing & Guarantee | Clear Choice Technical Services |

| Call Us Directly | Immediate Assistance | (972) 525-0888 [tel:+19725250888] |